According to a report recently released by international market research firm Markets and Markets, the Americas medium voltage cable market size is expected to be $11.1 billion in 2022.

This figure is expected to increase to $14.2 billion by 2027, growing at a compound annual growth rate of 5.1% during the period. Rapid industrialization and increased renewable energy generation are the main factors driving the growth of the medium voltage cable market demand in the region.

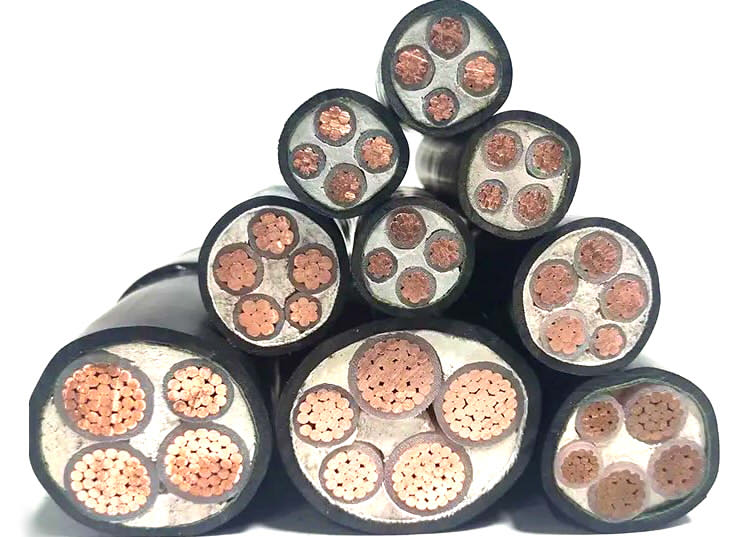

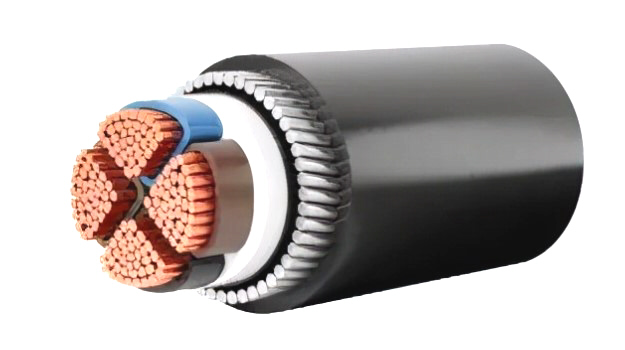

Medium voltage cables are used to interconnect equipment in large renewable energy projects such as solar, offshore wind and hydroelectric dams. They are also used to connect these projects to create private distribution networks (redes eléctricos de distribución) and to connect to the broader national grid.

The increase in U.S. solar and wind generation capacity is due to the country’s ongoing steps to decarbonize the power sector and address the environmental impacts of climate change. As a result, increased wind and solar power generation in the U.S. is expected to drive the growth of the medium voltage cable market, as these cables will be used to integrate electricity generated from solar and wind power into the grid.

Hins vegar, the economic slowdown triggered by the COVID-19 pandemic and high commodity prices are the challenges facing the medium voltage cable market. Companies across all regions have also witnessed supply chain disruptions and a decline in demand for medium voltage cables due to delays in energy and infrastructure projects. This has led to an increase in raw material procurement costs due to supply shortages, ultimately leading to order closures or delays.

Transmission and distribution network expansion projects are usually large-scale projects that involve large budget allocations from government authorities. Due to budget shortfalls, such projects are often mired in cumbersome approval processes or face funding problems.

The COVID-19 pandemic has delayed renewable energy projects in Latin America. Projects under development in the power sector are facing delays due to the embargo and movement restrictions imposed to contain the spread of the COVID-19 pandemic. Wind power projects in the United States are also expected to be delayed due to the embargo and supply chain disruptions.

On the basis of end-user market, it is segmented into industrial, commercial, and renewable energy. Renewable energy is expected to be the fastest growing segment during the forecast period. The Americas are shifting from conventional energy sources to renewable energy sources to reduce carbon emissions and reduce environmental pollution. The rapid influx of investments in renewable energy generation is expected to increase the demand for ancillary components required for renewable energy generation, smit, and distribution, such as energy storage equipment and power cables of medium and high voltage.

On the basis of laying type, the Americas medium voltage cable market is segmented into underground, overhead, and submarine cables, with overhead cables expected to be the major segment during the forecast period at a relatively lower cost than submarine and underground cable (cable enterrado) systems.