BENtanıtmak

Nikel kaynakları dünyada bol miktarda bulunmaktadır ve rezervlerin dağılımı nispeten yoğunlaşmıştır.. Nikel gümüş-beyaz bir metaldir, iyi sünekliğe sahip, manyetik ve korozyon direnci, olarak bilinen “demir çelik endüstrisinin vitamini”. Küresel nikel kaynakları zengindir, tüm dünyaya dağıtıldı, genel rezervler yükseliş eğilimi gösteriyor.

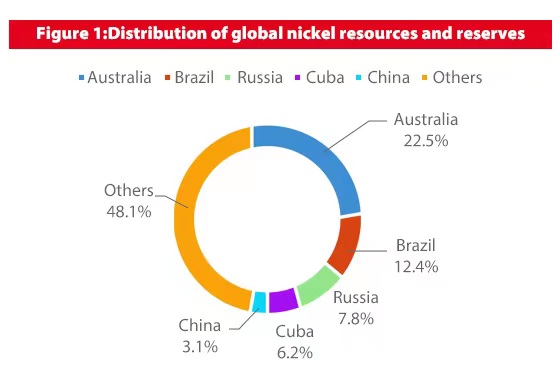

Küresel nikel kaynak rezervlerinin dağılımı verilerine göre 2019, küresel nikel kaynak rezervleri 89 milyon ton, Avustralya nikel kaynaklarının en bol olduğu ülkedir, muhasebe 22.5%. Brezilya takip etti 12.4%, Rusya 7.8%, Küba 6.2%, Çin 3.1%, vesaire. İlk beş ülke açıklandı 51.9% nikel rezervleri, nikel kaynak rezervlerinin dağılımı nispeten yoğunlaşmıştır.

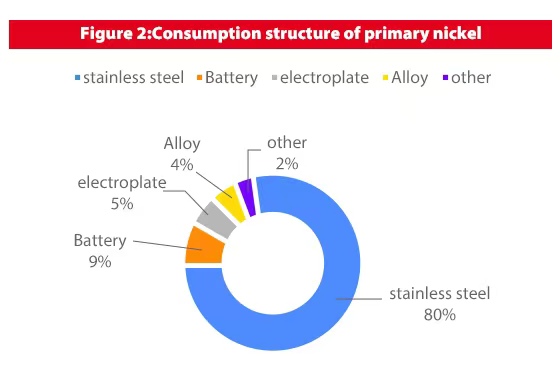

Paslanmaz çelik nikelin ana talep alanıdır, Ve yeni enerjili araç endüstrisi Pil tüketiminin oranını artırması bekleniyor. Doğumundan bu yana, Nikel, modern endüstride çoğunlukla paslanmaz çelik üretiminde kullanılmaktadır., ve aynı zamanda alaşımlarla da yaygın olarak ilgilenmektedir (nikel çeliği ve nikel gümüşü gibi), piller ve elektrokaplama. Birincil nikel tüketim yapısında 2019, paslanmaz çelik nikelin ana talep yönüdür, muhasebe 80%; Pil iken, elektrokaplama ve alaşım hesaba katıldı 9%, 5%, 4% sırasıyla, geleceğin paslanmaz çeliği istikrarlı bir büyümeyi sürdürecek 3-5%.

Son yıllarda yeni enerji otomobil endüstrisinin yükselişi nedeniyle nikel bataryaya olan talep artacak, Pil tüketiminin artması bekleniyor, nikeldeki ana artış olarak hareket ediyor, Nikel açığının gelecekte genişlemesi bekleniyor.

BHP Billiton, küresel nikel talebinin önümüzdeki dönemde dört kat artacağını söyledi 30 Yıllardır elektrikli araçlar geleneksel araçların yerini almaya devam ediyor.

Küresel nikel talebi dört katına çıkacak 2040

Dünyanın en büyük madencisinden her kişiden dokuzu bekleniyor 10 tarafından elektrikli olarak satılan araçlar 2040, nikel gibi önemli pil malzemelerinin küresel kullanımının artırılmasına yardımcı olmak. Otomotiv akülerinin ana büyüyen pazar olarak paslanmaz çeliğin yerini almasıyla nikel pazarı dönüşüme uğradı.

“Önümüzdeki dönemde nikel talebini bekliyoruz 30 olacak yıllar 200% ile 300% en son ne olduğuna dair 30 yıllar,” dedi Jess Farrell, BHP Nickel West Assets'in başkanı.

Hakkında 85 BHP'nin Batı Avustralya'daki nikel Batı rafinerisinde üretilen nikel sülfatın yüzde 100'ü halihazırda pil endüstrisinde kullanılıyor, ile karşılaştırıldığında 10 altı yıl önce yüzde. Madenci tesisi satmayı düşünmüştü, ama bu planı tersine çevirdi 2019 nikelin uzun vadeli beklentileri parlaklaştıkça.

Farrell, BHP'nin nikel işinin ABD'den fayda sağlayacağını söyledi. Başkan Joe Biden'ın enflasyonla mücadele yasası, ABD'ye yönelik teşvikler de dahil. otomobil üreticileri ABD'ye dost ülkelerden daha fazla hammadde tedarik edecek. Üreticiler elektrikli araç üretimi için vergi kredisi alacak, Yeterli miktarda girdinin ABD ile serbest ticaret anlaşması olan ülkelerden gelmesi şartıyla.

Nikel metalinin gelişimi

Gelişimin erken aşamasında, nikel sülfür cevheri baskındır, ve laterit cevheri arzı daha azdır. Nikel cevheri esas olarak laterit nikel cevheri ve nikel sülfür cevheri formunda bulunur.. Laterit nikel cevheri esas olarak tropikal ülkelerde dağıtılmaktadır. 30 Ekvator çizgisinin kuzey ve güney dereceleri, Güneydoğu Asya'da Endonezya ve Filipinler dahil, Amerika kıtasında Küba ve Brezilya, ve Sincan.

Laterit nikel cevheri bol miktarda kaynağa sahiptir, düşük madencilik maliyeti, ancak yüksek izabe maliyeti, ıslak eritme teknolojisi gibi karmaşıktır; Nikel sülfür cevheri esas olarak Kanada'da dağıtılmaktadır., Avustralya, Rusya, Çin ve diğer yerler, mineral eritme süreci olgunlaştı, daha fazla yan ürün, ancak madencilik maliyeti yüksektir.

Nikel cevherinin iki formu farklı endüstriyel zincirlere karşılık gelir, farklı ara ürünler ve nikelin nihai ürünleri ile sonuçlanır. Nikel cevherinin geliştirilmesinden bu yana, nikel sülfür cevherinin küresel üretimi baskındır, laterit nikel cevheri arzı az iken. Nikel sülfür cevheri ve laterit cevherinin çıktısının alınması 2000 örnek olarak, nikel sülfür cevheri üretimi açıklandı 60%, laterit nikel cevheri çıkışı ise 40%.

Laterit nikel cevherinin maliyet avantajı ferrik nikeli paslanmaz çeliğin hammaddesi olmaya itiyor. Laterit nikel cevheri, nikel cevheri pazarının gözdesi haline geliyor. Nikel cevherinin gelişiminin erken aşamasında, Piyasada paslanmaz çelik üretiminde hammadde olarak nikel sülfit cevherinden üretilen elektrolitik nikel kullanıldı.. Nikel sülfit cevherine olan büyük talep nikelin fiyatını artırdı ve bu nedenle paslanmaz çeliğin üretim maliyetini artırdı.

Laterit nikel cevheri toprağı kapandıkça, düşük madencilik maliyeti, Nikel sülfür cevheri geri kazanılabilir kaynaklara yönelik piyasa talebinin giderek azalmasıyla birlikte, ve içinde 2007 Alternatif elektrolitik nikel üretimi paslanmaz çelik nikel demir zanaatının kullanımını icat eden endüstriden sonra, laterit nikel cevheri uygulaması ortaya çıkıyor, arz miktarının kademeli olarak artması, Endonezya ve Filipinler'den güneydoğu Asya ülkelerine kadar insanların mayınları var.

İçinde 2019, laterit nikel cevheri üretimi arttı 64%, nikel sülfit cevherininki ise azaldı 36%. Her iki nikel cevheri formunun oranının değişme eğiliminden, laterit nikel cevheri oranının yıldan yıla arttığı görülebilir., ve şu ana kadar hakim konumu işgal etti.

Endonezya'daki madencilik yasağı ve Filipinler'deki çevre koruma politikaları, küresel laterit nikel cevheri arzını etkileyerek arz ve talep arasındaki açığı daralttı.. Laterit nikel cevheri kullanma sürecinde, Endonezya'da çeşitli madencilik yasakları ve Filipinler'de çevre koruma politikalarıyla karşılaştı.

Endonezya ve Filipinler, laterit nikel cevheri üretiminde dünyada birinci ve ikinci sırada yer alıyor. İlgili politikaların uygulanması, bu iki ülkede laterit nikel cevheri üretiminin azalmasına yol açtı, Bu durum küresel laterit nikel cevheri arzını etkiledi ve nikel cevheri arzı ile talebi arasındaki açığı daralttı.

Endonezya'daki madencilik yasakları ve Filipinler'deki çevre politikaları laterit arzını azalttı. Endonezya ve Filipinler, laterit nikel üretiminde birinci ve ikinci sırada yer alıyor, muhasebe 29.63% Ve 13.22% sırasıyla 2019. Endonezya'daki madencilik yasağı ve Filipinler'deki çevre koruma politikaları, iki ülkedeki laterit nikel üretimini önemli ölçüde azalttı, küresel laterit nikel arzında düşüşe yol açıyor, nikel ve paslanmaz çelik pazarları arasındaki boşluğu genişletiyor.

Laterit nikel cevheri talep açısı: Paslanmaz çeliğe yönelik istikrarlı talep artışı, laterit nikel cevheri endüstrisinin hızlı gelişimini tetikliyor. Paslanmaz çelik uzun süredir nikelin ana tüketim alanını işgal ediyor, içinde 2019 paslanmaz çelik talebi karşılandı 80%. Korozyon direnci ve yüksek sıcaklık dayanımı ve diğer mükemmel performans nedeniyle paslanmaz çelik, ömrü diğer çelik türlerine göre daha yüksektir, yaygın olarak kullanılan pazardaki çeşitli endüstriler tarafından geri dönüştürülebilir, ağırlıklı olarak endüstriyel ve sivil alanlar, alt tüketici dağıldı, Paslanmaz çelik pazarının belirli sektörlerden etkilenmesinin kolay olmaması.

Öyleyse, Paslanmaz çeliğe yönelik istikrarlı talep artışı, laterit nikel endüstrisinin hızlı gelişimini tetikliyor. Buradaki verilere göre 2019, Paslanmaz çeliğin alt tüketim sonu arasında, Boru yapım endüstrisi en çok paslanmaz çelik tüketiyor, muhasebe 30.1%, ardından donanım ürünleri geliyor 15.3%, bina dekorasyonu 11.3% ve ev aletleri sektörü 9.0%. Paslanmaz çelik aynı zamanda ekipman imalatında da yaygın olarak kullanılmaktadır., otomobil endüstrisi, petrokimya, elektronik ve çevre koruma endüstrileri.