Introduce

Nickel resources are abundant in the world and the distribution of reserves is relatively concentrated. Nickel is a silver-white metal, with good ductility, magnetic and corrosion resistance, known as the “vitamin of the iron and steel industry”. The global nickel resources are rich, distributed all over the world, the overall reserves show a rising trend.

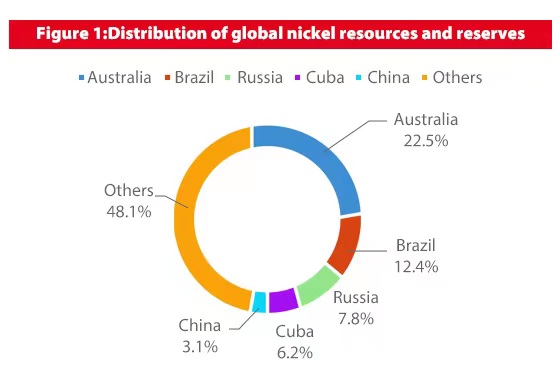

According to the data of global nickel resource reserves distribution in 2019, the global nickel resource reserves are 89 nde tọn, among which Australia is the most abundant country in nickel resources, accounting for 22.5%. Brazil followed by 12.4%, Russia 7.8%, Cuba 6.2%, China 3.1%, wdg. The top five countries accounted for 51.9% of nickel reserves, nickel resource reserves distribution is relatively concentrated.

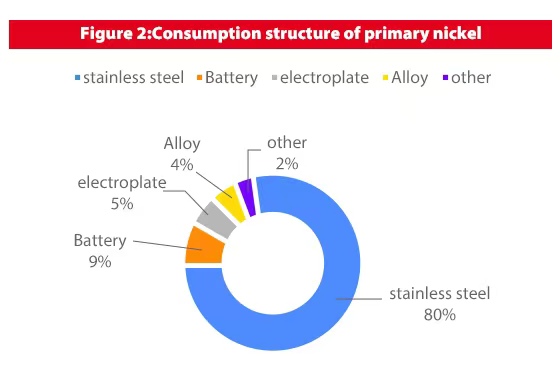

Stainless steel is the main demand area for nickel, na the new energy vehicle industry is expected to boost the proportion of battery consumption. Since its birth, nickel has been mostly used in the production of stainless steel in modern industry, and is also widely involved in alloys (such as nickel steel and nickel silver), batteries and electroplating. In the primary nickel consumption structure in 2019, stainless steel is the main demand aspect of nickel, accounting for 80%; While battery, electroplating and alloy accounted for 9%, 5%, 4% respectively, the future stainless steel will maintain a stable growth of 3-5%.

Due to the rise of the new energy automobile industry in recent years will drive the demand for nickel battery, battery consumption is expected to increase, acting as the main increase in nickel, nickel gap is expected to expand in the future.

BHP Billiton says global demand for nickel is set to increase as much as fourfold over the next 30 years as electric vehicles continue to displace conventional vehicles.

Global demand for nickel will quadruple by 2040

The world’s largest miner expects nine out of every 10 vehicles sold to be electric by 2040, helping to boost the global use of key battery materials such as nickel. The nickel market has been transformed as automotive batteries have replaced stainless steel as the main growth market.

“We expect nickel demand in the next 30 years to be 200% ka 300% of what it was in the last 30 afọ,” said Jess Farrell, president of BHP Nickel West Assets.

Ihe gbasara 85 percent of nickel sulfate produced at BHP’s nickel West refinery in Western Australia is already used in the battery industry, compared with 10 percent six years ago. The miner had considered selling the plant, but reversed that plan in 2019 as nickel’s long-term prospects brightened.

Farrell said BHP’s nickel business would benefit from U.S. President Joe Biden’s anti-inflation legislation, which includes incentives for U.S. automakers to source more raw materials from countries friendly to the United States. Manufacturers will receive tax credits for producing electric vehicles, provided enough of their inputs come from countries that have free trade agreements with the United States.

The development of nickel metal

In the early stage of development, the nickel sulfide ore is dominant, and the laterite ore supply is less. Nickel ore mainly exists in the form of laterite nickel ore and nickel sulfide ore. Laterite nickel ore is mainly distributed in tropical countries within 30 degrees north and south of the equatorial line, including Indonesia and the Philippines in Southeast Asia, Cuba and Brazil in the Americas, and Xinjia.

Laterite nickel ore has abundant resources, low mining cost, but high smelting cost, such as wet smelting technology is complex; Nickel sulfide ore is mainly distributed in Canada, Ọstrelia, Russia, China and other places, the mineral smelting process is mature, more by-products, but the mining cost is high.

The two forms of nickel ore correspond to different industrial chains, resulting in different intermediate products and finished products of nickel. Since the development of nickel ore, the global output of nickel sulfide ore is dominant, while the supply of laterite nickel ore is small. Taking the output of nickel sulfide ore and laterite ore in 2000 as an example, the output of nickel sulfide ore accounted for 60%, while the output of laterite nickel ore accounted for 40%.

The cost advantage of laterite nickel ore drives ferric nickel to become the raw material of stainless steel. Laterite nickel ore is becoming the favorite of nickel ore market. In the early stage of the development of nickel ore, electrolytic nickel produced from nickel sulfide ore was used as the raw material for the production of stainless steel in the market. The large demand for nickel sulfide ore increased the price of nickel and therefore increased the production cost of stainless steel.

As laterite nickel ore soil close, low mining cost, combined with the market demand of nickel sulfide ore recoverable resources gradually decrease, and in 2007 after the industry who invented the use of alternative electrolytic nickel production stainless steel nickel iron craft, laterite nickel ore application emerge, supply quantity increase gradually, people have mines in Indonesia and the Philippines to southeast Asian countries.

N'ime 2019, the output of laterite nickel ore increased to 64%, while that of nickel sulfide ore decreased to 36%. It can be seen from the changing trend of the proportion of the two forms of nickel ore that the proportion of laterite nickel ore has been increasing year after year, and it has occupied the dominant position so far.

The mining ban in Indonesia and environmental protection policies in the Philippines have affected the global laterite nickel ore supply and tightened the gap between supply and demand. In the process of using laterite nickel ore, it has experienced several mining bans in Indonesia and environmental protection policies in the Philippines.

Indonesia and the Philippines rank first and second in the world in terms of laterite nickel ore production. The implementation of corresponding policies has led to the reduction of laterite nickel ore production in these two countries, which has affected the global laterite nickel ore supply and tightened the gap between nickel ore supply and demand.

Mining bans in Indonesia and environmental policies in the Philippines have reduced laterite supplies. Indonesia and the Philippines rank first and second in terms of laterite nickel production, accounting for 29.63% na 13.22% respectively in 2019. The mining ban in Indonesia and environmental protection policies in the Philippines have significantly reduced laterite nickel production in the two countries, leading to a decline in the global laterite nickel supply, widening the gap between the nickel and stainless steel markets.

Laterite nickel ore demand Angle: The stable demand growth of stainless steel drives the rapid development of laterite nickel ore industry. Stainless steel has long occupied the main consumption area of nickel, in 2019 stainless steel demand accounted for 80%. And stainless steel due to corrosion resistance and high temperature resistance and other excellent performance, life is higher than other types of steel, can be recycled by various industries in the market widely used, mainly industrial and civil fields, downstream consumer dispersed, making the stainless steel market is not easy to be affected by specific industries.

Ya mere, the stable demand growth of stainless steel drives the rapid development of laterite nickel industry. According to the data in 2019, among the downstream consumption end of stainless steel, the pipe making industry consumes the most stainless steel, accounting for 30.1%, followed by hardware products 15.3%, building decoration 11.3% and home appliance industry 9.0%. Stainless steel is also widely used in equipment manufacturing, automobile industry, petrochemical, electronics and environmental protection industries.